Overview

Overview

The Department of Finance is responsible for the administration of activities pertaining to the receipt, expenditure, accounting, investment, custody and control of Township funds. The department also assists the Township Manager in the presentation of the annual budget and capital improvement plan for approval by the elected Board of Commissioners.

Act 44 Disclosure

Act 44 Disclosure

The Act 44 Disclosure Law requires service providers to the Haverford Township Pension Plans to provide certain disclosures on an annual basis. Act 44 also requires would-be service providers to provide certain disclosures in connection with their bids for services. Select one of the documents below to review the service provider's disclosure.. Service Providers

Act 57 of 2022 - Effect of Failure to Receive Tax Notice

Act 57 of 2022 - Effect of Failure to Receive Tax Notice

Act 57 of 2022 amends the Local Tax Collection Law and allows taxpayers who failed to receive a tax notice during their first year of occupancy, to apply for a waiver from penalties and additional costs from the tax collector. The Act's provisions apply to tax years beginning on and after January 1, 2023.

If this situation applies and you properly qualify, please complete the Request for Waiver form and submit the form:

By mail/in person: Haverford Township Finance Department 1014 Darby Rd Havertown PA 19083

Via Email: finance@havtwp.com

Approved Warrants & Check Registers

Approved Warrants & Check Registers

| Date | Check Register Link | Invoices by GL Account Link |

|---|---|---|

| January 12, 2026 | Check Register(opens in a new tab) | Invoice by GL(opens in a new tab) |

| February , 2026 | Check Register(opens in a new tab) | Invoice by GL(opens in a new tab) |

| Year | Check Register Link | Invoices by GL Account Link |

|---|---|---|

| 2025 | Check Register Link | Invoice by GL (opens in a new tab) |

| 2024 | Check Register(opens in a new tab) | Invoice by GL (opens in a new tab) |

| 2023 | Check Register Link(opens in a new tab) | Invoice by GL(opens in a new tab) |

Audited Financial Statements

Audited Financial Statements

The Department of Finance is responsible for the administration of activities pertaining to the receipt, expenditure, accounting, investment, custody and control of Township funds. The department also assists the Township Manager in the presentation of the annual budget and capital improvement plan for approval by the elected Board of Commissioners.

Audited Financial Statements via year

Bulk Trash Pickup Info & Online Payment

Bulk Trash Pickup Info & Online Payment

Haverford Township provides residential bulk trash pickup for large household items and appliances.

Public Works: 610-446-1000 ext. 2263 or 2264 or email publicworks@havtwp.com

Schedule a Pickup:

Collections take place on Wednesdays and can take up to 48 hours for the collection to be completed.

Items must be placed at the curb by 7:00 AM Wednesday mornings.

If items are still left by end of day, the items will be collected the following day.

If your scheduled bulk trash item is still outside on Thursday, call or e-mail the Public Works Department.

Please Note:

Effective January 14, 2025, fees for Bulk Trash collections are as follows:

Business Tax Overview

Business Tax Overview

The Township of Haverford imposes three business related taxes under Act 511: the Business Privilege tax, the Mercantile tax, and the Local Services Tax. All individuals or companies doing business within the Township should obtain an annual business tax license issued from Tri-State Financial Group, LLC, the Township's official business tax collector.

Tri-State Financial Group, LLC

Go to the far right side of the website, then click on

"Haverford Township Tax Forms"

610-270-9520.

The Mercantile Tax (MT) is assessed on all retail and wholesale related business activities while the Business Privilege (BPT) is assessed on all other business activities. Both taxes are based on gross receipts. Business Privilege taxes are at the rate of 1.5 mills ($1.50 per $1,000) of gross receipts and Mercantile taxes are at the rate of 1.5 mill ($1.50 per $1,000) of gross retail receipts or 1.0 mills ($1.00 per $1,000) of gross wholesale receipts. Returns are due April 15 of each year for activity in the previous calendar year.

Haverford Township does not currently have an earned income tax. For informational purposes, the Township PSD (Political Subdivision) Code is 230401 and for more information on whether your residence or employer location has an enacted earned income tax, please visit the Commonwealth’s website at Find Local Tax (opens in a new tab)

The Local Services Tax is imposed upon each individual engaged in any occupation in the Township. It is the responsibility of the employer to deduct, from their employees, the tax of $52 per year at a rate of $1 per week employed. This tax is imposed on all income earned in the Township whether salary, wages or commission. The employer must then file quarterly returns to Tri-State Financial Group, LLC remitting the taxes deducted. All self-employed individuals are required to remit their tax as well. Anyone earning less than $12,000 during the year may file an exemption form with their employer. It is the employer's responsibility to implement this exemption. If the employee has not filed an exemption and has paid the tax, the employee is entitled to a refund upon presentation of proof of earnings. Also, anyone who may have had the tax deducted twice in the same year from different employers is entitled to a refund upon presentation of proof of deductions.

Tax Collection and Compliance

All questions regarding forms, compliance and collection with the tax should be directed to Tri-State Financial Group, LLC

Audit and Compliance Program - the Township reserves the right to audit and inspect all books and records of a taxpayer to support the information reported on taxpayer filed returns.

Real Estate Tax Payment

Real Estate Tax Payment

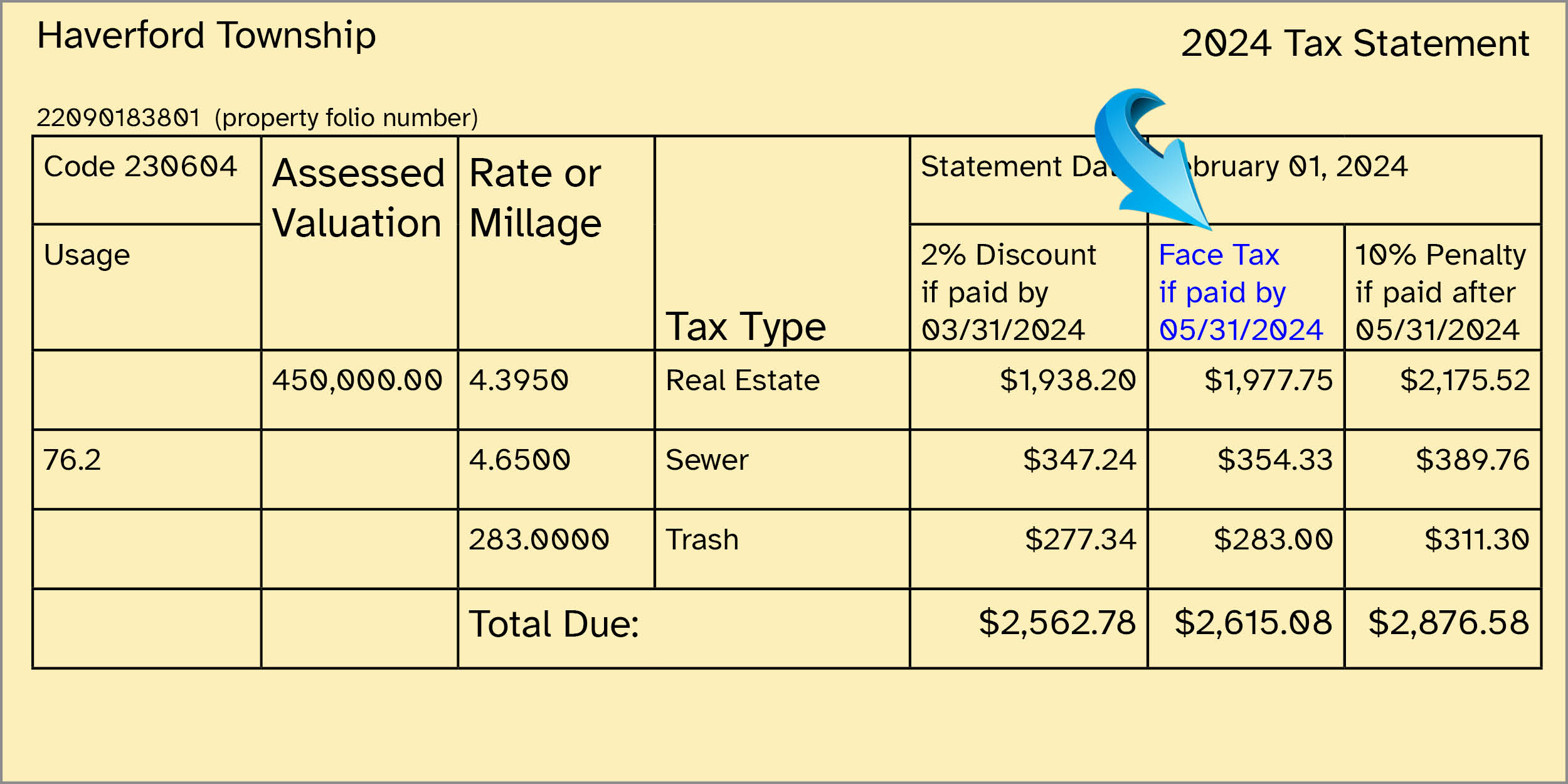

**Online payment services opens at the start of the tax season on February 1st.

You can pay your Real Estate, Sewer & Trash Bill from the comfort of your home or office by using our online payment service starting February 1st. Credit cards accepted: MasterCard, Discover, American Express or Visa. A per transaction fee of 2.65% or $3.00 minimum will be charged by the payment processing company for this service. Electronic Check service is also available through the same portal. A transaction fee of $1.50 will be charged by the payment processing company for this service.

To process a payment online, you will need the property folio (or account) number, owner's name and property address.

As partial payments are not acceptable, only payments in full, At 2% Discount are acceptable at this time. Any transactions other than payment in full will be VOIDED or RETURNED (and cardholder will forfeit the convenience fee charged). See the sample bill below for locations of the property folio number and amount due.

Property Tax Overview

Property Tax Overview

Township property taxes fund a multitude of services carried out by the more than 300 full-time and seasonal employees of Haverford Township. These services include police protection, financial support to five (5) area Fire Companies, basic and advanced life support ambulance services, financial support to the Township Library, snow and ice removal, road maintenance and repair, street light maintenance and repair, traffic signal maintenance and repair, park maintenance, park and recreation program development, building codes and zoning enforcement and compliance with health standards and regulations.

Properties are taxed based on information and assessments provided by the Delaware County Assessors Office. Questions regarding individual property assessments should be directed to the County officers at (610) 891-4379. It's important to note that a property's total real estate taxes are comprised of three taxes from three different taxing authorities. Each taxing authority -- Delaware County, Haverford Township School District and Haverford Township -- each set their own rates and bill and collect their own taxes.

Each year as part of the budget process, the Board of Commissioners enacts an Ordinance setting the Township property tax millage rate for the coming year. Taxes are figured by taking the property assessment and multiplying by the millage rate in effect for that particular tax year and dividing by 1000. A sample annual tax bill, using an average property (residential and commercial) assessment of $346,000, is calculated as follows:

Haverford Township Taxes: $346,000*4.695 mills/1000 = $1,624

Delaware County Taxes: $346,000*4.609 mills/1000 = $1,595

Haverford Twp School District: Haverford Twp School District: $346,000*19.6509 mills/1000 = $6,799

Annual sewer rent and trash collection fees are also billed together with the Township tax on the same bill.

Township tax bills are generally mailed out by February 1 of each year and can be paid in person at the Township building or mailed to either the Township building or the Township lockbox.

There is a 2% discount for payment made by March 31 and a 10% penalty for any payments made after May 31. If a property tax bill is unpaid as of December 31, the Township turns the tax portion of the bill over to Delaware County Tax Claim Bureau, where the property is then subject to Sheriff Sale. The sewer rent and trash fee portion of the delinquent bill remains at the Township level. These amounts must be paid directly to the Township and the property owner must contact the Township directly for final payoff figures. Payoff amounts must be requested in writing for the same fee as a tax certification.

For further information on the other two components of your total real estate tax bill, please contact the following:

• Delaware County (610) 891-4278

• Haverford Township School District (610) 853-5900 ext. 7104

Sewer Rent and Second Meter Credits

Sewer Rent and Second Meter Credits

Every property -- residential, commercial, or exempt -- connected to the public sewer system is required to pay an annual sewer rent for that service. Annual sewer rent is based on the water usage (10/1 thru 9/30) according to data supplied to the Township by Aqua PA. Any questions related to water consumption shown on your bill should be directed to Aqua PA at (610) 645-1038. Sewer rents are billed on the Township tax bill which is generally mailed out by February 1 of each year. We offer a 2% discount for sewer rents paid by March 31 and a 10% penalty will apply for any payment received after May 31. The sewer rental rate is determined by the Board of Commissioners as part of the annual budget process and is enacted via Ordinance. If a property owner does not pay their sewer rent by December 31, the Township files a formal lien against the property and reserves the right to pursue formal judgments and Sheriff Sale. Additional interest also accrues at a rate of 10% per annum and lien fees/attorney costs will be added.

Refunds are made to individual sewer bills when separate meters can document the amount of water that has been diverted from the public sewer system (for a swimming pool, outdoor sprinkler system, etc.). For example, if a resident has a sprinkler system or pool, and installs a separate (second) meter, the Township will refund sewer rents paid for that water usage. Second meters can be purchased at a hardware store or contact a plumber for more information on installation. After installation, the Township must be notified for credit eligibility. To qualify for the credit, the entire sewer bill must be paid in full. Upon receipt of full payment plus documentation of the second meter reading, a refund check will be issued to the property owners. Proper documentation is established with a photo showing the initial second meter reading of "0" and the meter reading as of September 30 of each year.

Township Budget

Township Budget

Trash Fee

Trash Fee

Residential trash is collected by the Haverford Township Sanitation Department. The current practice of twice per week trash, weekly recycling and weekly brush collection is financed largely by a service fee paid by residential property owners. Trash service fees are billed on the annual Township tax bill which is generally mailed out by February 1 of each year. We offer a 2% discount for trash service fees paid by March 31 and a 10% penalty will apply for any payment received after May 31. The trash service fee is determined by the Board of Commissioners as part of the annual budget process and is enacted via Ordinance. If a property owner does not pay their trash service fee by December 31, the Township files a formal lien against the property and reserves the right to pursue formal judgments and Sheriff Sale. Additional interest also accrues at a rate of 10% per annum and lien fees/attorney costs will be added.

Page Updated | 02/19/2026